2026 Membership Renewal Process

Be a part of the REALTOR® Difference and renew your membership by October 1st!

We appreciate your continued membership with Cobb REALTORS®!

Renewal Information:

Renewal Information:

- Renewal Invoices: Renewal Invoices will be emailed.

- Payment Due Date: October 1st, 2025

- Designated REALTORS® (DRs) will also receive renewal information to share with their agents, along with updates on who has not yet renewed in their office.

- Online renewal opens September 6th.

Late Payment Fees:

- If the balance is not paid by October 1st, 2025, a $25 late fee will be added.

- After November 1st, 2025, an additional $25 fee will be charged (totaling $50).

- After December 1st, 2025, another $25 fee will be applied, bringing the total late charges to $75.

Membership Termination:

- If your dues are not paid by December 31st, 2025, your membership with NAR, GAR, and Cobb Association of REALTORS® will be terminated.

- To reinstate your membership, there is a $100 fee plus the 2026 dues and late fees.

Refunds:

- Dues may be refunded within 30 days of receipt. Dues will be refunded on a proration of Local, State, and National dues for the current month. No refunds shall be made if the money has already been transferred to the respective organization.

Account Access:

- If you don’t know your username or password, you can request a reset directly from the login screen. If your Membership Info Hub account has not yet been set up, please contact us at [email protected] for assistance.

Mail-in Option:

You may also mail your renewal to:

Cobb Association of REALTORS®

444 Manget Street SE, Suite 100

Marietta, GA 30060

Please include a copy of your invoice or note your real estate license number on the check.

Questions about your membership?

- Call 770.422.3900 or email [email protected].

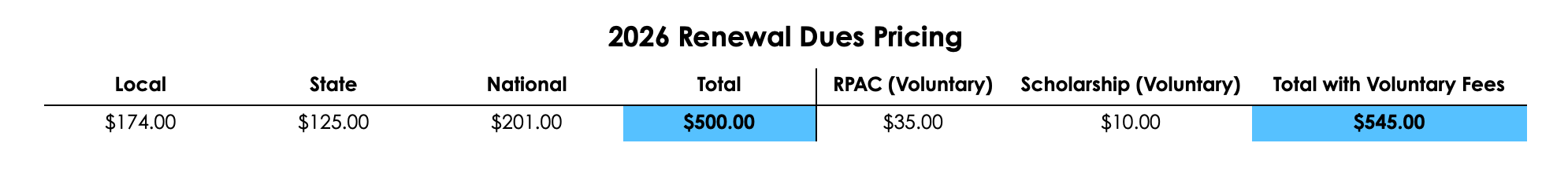

Membership Fees and Tax Information:

REALTOR® Tax Deduction Notice:

The portion of dues paid that is spent to lobby the State and Federal governments is not deductible for income tax purposes. GAR has estimated that $13.60 (11.06%) is the nondeductible portion of 2026 GAR dues. NAR has estimated the nondeductible portion of its 2026 dues to be $55.00 (or 35%). The entire $45.00 NAR Consumer Advertising Campaign Assessment qualifies as deductible dues.

RPAC Disclaimer:

Contributions are not deductible for Federal income tax purposes. RPAC contributions are voluntary and used for political purposes. You may refuse to contribute without reprisal or otherwise affecting your membership rights. Seventy percent of your contribution goes to your State Association to support state and local political candidates. Thirty percent is sent to National RPAC to support Federal candidates against your limits under 2 U.S.C. 441a.

Renewal Information:

Renewal Information: